PENomizer™

Revenue Architectur

Everyday PENomizer Tier + Refined Cartridge Dynamics

Assumptions

Vessel economics

-

Wholesale: $20

(MSRP ~$39–49) - Y1 sales per Maison/Country: 200k units

- Maison vessel margin: ~45%

Cartridge pack Economics

-

3-pack wholesale:

$54

(MSRP ~$90–115) -

COGS per pack:

~$18 →

Maison margin

~65%

Usage behavior

(packs per year per active user)

-

Mid/high school:

4 packs (≈ 1 pack every

3 months) - Gen Z: 5 packs

- Millennials: 6 packs

- Weighted average ≈ 5 packs / yr / active user

Attach rate

- Y1: 65%

- Y2: 75%

- Y3: 80%

Starter cartridge pack

- bundled with vessel at launch (1 × 3-pack).

Demographic mix:

- Mid/high school (30%), Gen Z (40%), Millennials (30%).

Monaco royalties:

- Negotiable licensing royalties (vessel + cartridges or combined).

Upfront license fee:

- IP reasonable & customary per Maison.

Everyday PENomizer (Per Maison × 1 Country)

Year-1

Vessels sold:

200k × $20

= $4.0M

Starter cartridge packs:

200k × $54

= $10.8M

Cartridge refill packs:

65% × 200k × 5 packs × $54

= $35.1M

Total Y1 sales $49.9M.

Year-2

New vessels:

250k × $20

= $5.0M

New starter cartridge packs:

250k × $54

= $13.5M

Refills:

Y1 base

200k × 75% × 5 × $54

= $40.5M

Y2 base

250k × 75% × 5 × $54

= $50.6M

Year-3

New vessels:

313k × $20

= $6.3M

New starter cartridge packs:

313k × $54

= $16.9M

Cartridge refill packs:

Y1 base

200k × 80% × 5 × $54

= $43.2M

Y2 base

250k × 80% × 5 × $54

= $54.0M

Y3 base

313k × 80% × 5 × $54

= $67.6M

Maison Profitability

| Year | Total Sales | Maison Gross Profit (45% vessels, 65% packs) | Maison Net Contribution |

|---|---|---|---|

| Y1 | $49.9M | ~$31.6M | $31.6M (less Fees) |

| Y2 | $109.6M | ~$70.3M | $70.3M (less Fees) |

| Y3 | $188.0M | ~$121.0M | $121.1M (less Fees) |

(incremental to total sales, pre-licensing fees), 1 Country, 1 Maison.

Scaled Scenarios

(Everyday PENomizer Tier, 3 Years)

| Scenario | Launches (Maisons × Countries) |

3-Year Total Sales | Maison 3-Year Net Contribution |

|---|---|---|---|

| 1 Maison × 1 Country | 1 | $347.5M | $222.9M |

| 1 Maison × 10 Countries | 10 | $3.47B | $2.23B |

| 5 Maisons × 10 Countries | 50 | $17.35B | $11.15B |

| 10 Maisons × 20 Countries | 200 | $69.4B | $44.6B |

Key Takeaways

Cartridge packs lock

in repeat revenue:

each user buys 4–6 packs per year, no loose singles, only for promotional fragrance launch events.

Business Model:

PENomizer is a platform with SaaS-like economics (recurring royalties, 70%+ margin, asset-light).

Rapid payback:

$12M less fees PENomizer platform contribution to a Maison in the first year from a single-country launch.

Category expansion —

portable, collectible PENo vessels complement rather than compete with EDP/EDT bottles.

Scalability -

at Inter Parfums’ multi-brand, multi-country scale, PENomizer can deliver multi-billion recurring revenues in just a few years.

Demographic fit —

mid-high schoolers, Gen Z, and Millennials are price sensitive but refill hungry, perfect for the 3-pack model.

Luxury Tier (Heritage Maisons, Haute Parfumerie)

Assumptions

Vessel economics

- Wholesale: $75 (MSRP $150+)

- Y1 sales per Maison/Country: 100k units

- Maison vessel margin: ~50%

Cartridge pack Economics

-

3-pack wholesale:

$105

(MSRP ~$210–$240) -

COGS per pack:

~$37 → Maison margin ~65%

Usage behavior

(packs per year per active user)

- Mid/high school: packs (shares with parents)

- Gen Z: 2 packs

- Millennials: 4 packs

- Gen X: 4 packs

- Boomers: 2 packs

- Weighted average ≈ 3 packs / yr / active user

Attach rate

- Y1: 65%

- Y2: 75%

- Y3: 80%

Starter cartridge pack

- bundled with vessel at launch (1 × 3-pack).

Demographic mix:

-

Gen Z (20%),

Millennials (40%),

Gen X (40%),

Boomers (20%).

Monaco royalties:

- Negotiable licensing royalties (vessel + cartridges or combined).

Upfront license fee:

- IP reasonable & customary per Maison.

Luxury Tier PENomizer (Per Maison × 1 Country)

Year-1

100k × $75

= $7.5M

100k × $105

= $10.5M

= $20.5M

Total Y1 sales $38.5M.

Year-2

New vessels:

250k × $20

= $9.4M

New starter cartridge packs:

250k × $54

= $13.1M

Refills:

Y1 base

100k × 75% × 3 × $105

= $23.6M

Y2 base

125k × 75% × 3 × $105

= $29.5M

Total Y2 sales $75.6M

Year-3

New vessels:

156k × $75

= $11.7M

New starter cartridge packs:

156k × $105

= $16.4M

Cartridge refill packs:

Y1 base

100k × 80% × 3 × $105

= $25.2M

Y2 base

125k × 80% × 3 × $105

= $31.5M

Y3 base

156k × 80% × 3 × $105

= $39.1M

Total Y3 sales $123.9M

Luxury Tier Maison Profitability

| Year | Total Sales | Maison Gross Profit (45% vessels, 65% packs) | Maison Net Contribution |

|---|---|---|---|

| Y1 | $38.5M | ~$23.9M | $23.9M (less Fees) |

| Y2 | $75.6M | ~$47.7M | $47.7M (less Fees) |

| Y3 | $123.9M | ~$78.8M | $78.8M (less Fees) |

Maison 3-Year Net Contribution ≈ $150.4M

(incremental to total sales, pre-licensing fees), 1 Country, 1 Maison.

Scaled Scenarios

(Everyday PENomizer Tier, 3 Years)

| Scenario | Launches (Maisons × Countries) |

3-Year Total Sales | Maison 3-Year Net Contribution |

|---|---|---|---|

| 1 Maison × 1 Country | 1 | $238.0M | $150.4M |

| 1 Maison × 10 Countries | 10 | $2.38B | $1.5B |

| 5 Maisons × 10 Countries | 50 | $11.9B | $7.5B |

| 10 Maisons × 20 Countries | 200 | $47.6B | $30.0B |

Takeaways for Conglomerates

PENomizer is

tier-flexible

Maisons can choose Luxury, Mid-Tier, or Everyday positioning (or run all three across portfolio).

Recurring revenue is

guaranteed

Cartridge 3-packs ensure durable consumption cycles (4–6 sets/yr).

Payback is rapid

Single country launch repays Maison launch costs within months.

Portfolio leverage is

massive

Scaling even modestly across brands/countries leads to multi-billion revenue streams.

Non-cannibalizing

Expands fragrance into portable, collectible, refillable category — adds to bottles, doesn’t replace them.

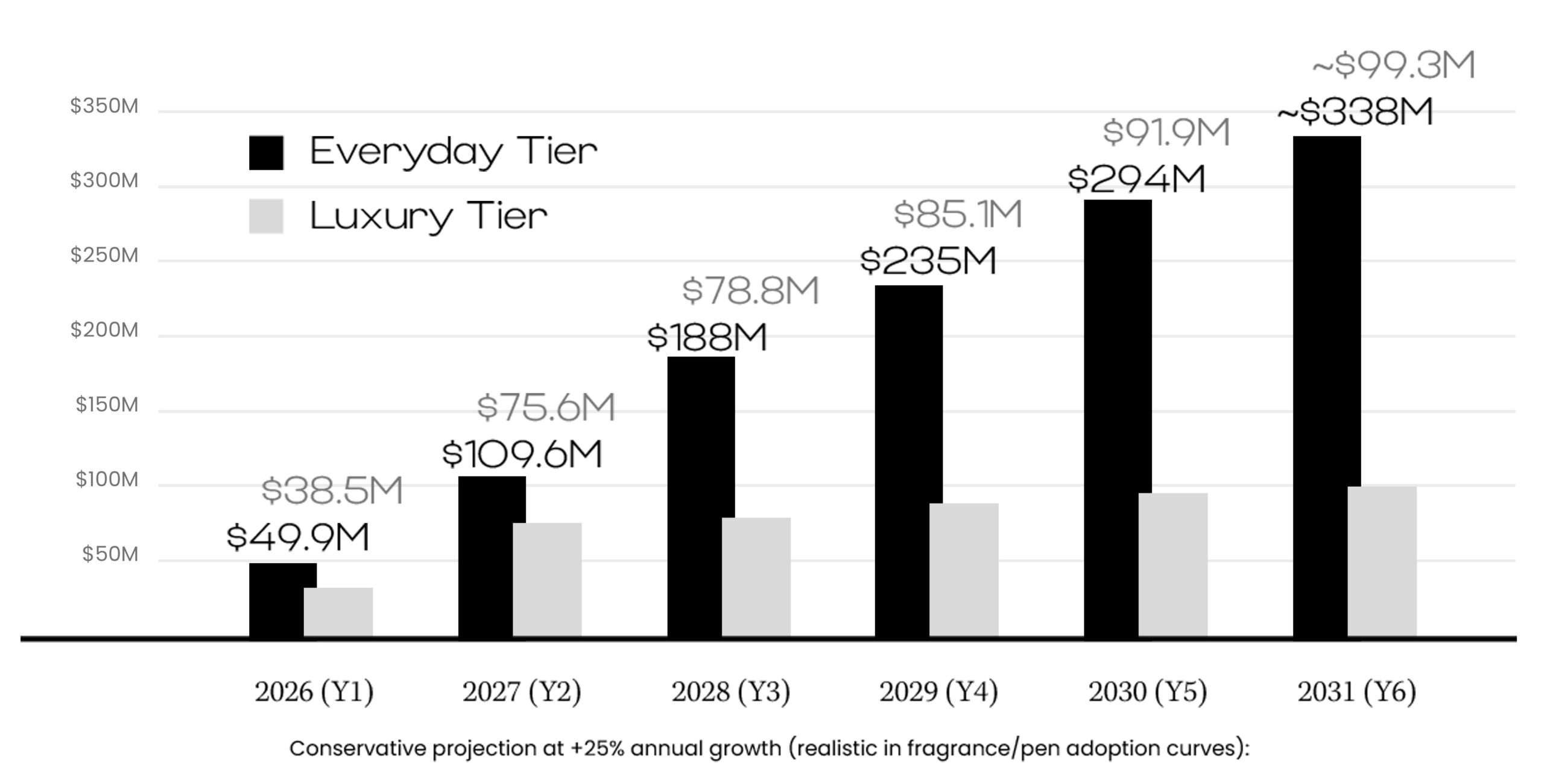

PENomizer — Revenue Trajectory

(Per Maison × 1 Country)

Maison 3-Year Net Contribution ≈ $150.4M

(incremental to total sales, pre-licensing fees), 1 Country, 1 Maison.

CAGR 2026–2031 (Now Y1–Y6)

Everyday PENomizer

With 2026 as launch year, both tiers show exceptional CAGR through 2031

≈ 47% CAGR

Luxury PENomizer

With 2026 as launch year, both tiers show exceptional CAGR through 2031

≈ 21% CAGR

Takeaway

This makes the Maison’s PENomizer business a hypergrowth add-on compared to the core fragrance market’s

≈ 6%

CAGR

LAMY isn’t only “student pens” and Montblanc isn’t only $1,000+ fountain pens. Both have collections that span a range of pricing tiers, from moderately priced “everyday” models to highly collectible luxury editions.

For PENomizer, that means both Penmakers can run multi-tier PENo strategies.

PENmaker PENo Vessel Revenue Framework (Per Maison × 1 Country, 2026–2031)

Moderately Priced

Everyday PENos

(LAMY-type baseline, but also Montblanc entry-level collections)

Wholesale price:

$20–$40

Annual unit volumes:

200k (Y1) → ~500k by Y6

Margins:

~45%

Use case:

school/university, Gen Z, Millennials; gifting.

Premium

PENos

(LAMY Studio / Montblanc Classique)

Wholesale price:

$75–$150

Annual unit volumes:

50k (Y1) → ~80k by Y6

Margins:

~50%

Use case:

professional / aspirational buyers, young execs, gifting.

Luxury / Bespoke

PENos

(Montblanc Patron of the Arts, Limited Editions; LAMY Signature/Design Studio Editions)

Wholesale price:

~$500–$1,500+

Annual unit volumes:

5k–10k (very limited runs)

Margins:

55–60%

Use case:

collectors, UHNWIs, Maison collaboration exclusives.

Trajectory

Combined PENmaker Opportunity

(Per Country, 2026–2031)

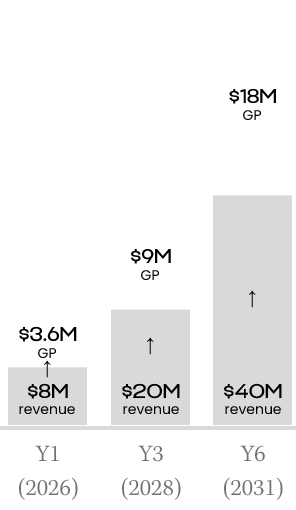

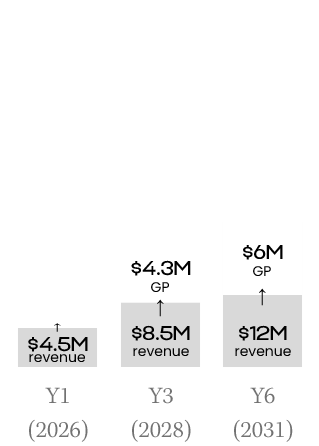

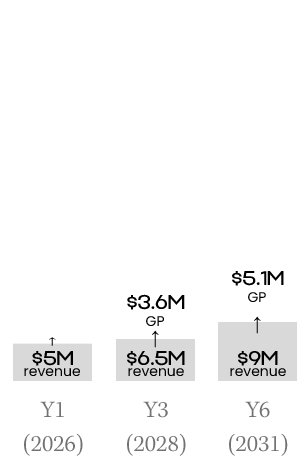

| Segment | Y1 Sales | Y3 Sales | Y6 Sales | CAGR 2026–2031 |

|---|---|---|---|---|

| Everyday PENos | $8.0M | $20M | $40M | ~32% |

| Premium PENos | $4.5M | $8.5M | $12M | ~20% |

| Luxury/Bespoke PENos | $5M | $6.5M | $9.0M | ~11% |

| Total PENos | $17.5M | $35M | $61M | ~26% CAGR |

Maison 3-Year Net Contribution ≈ $150.4M

(incremental to total sales, pre-licensing fees), 1 Country, 1 Maison.

Scaled Scenarios

(Everyday PENomizer Tier, 3 Years)

| Scenario | Launches (Maisons × Countries) |

3-Year Total Sales | Maison 3-Year Net Contribution |

|---|---|---|---|

| 1 Maison × 1 Country | 1 | $238.0M | $150.4M |

| 1 Maison × 10 Countries | 10 | $2.38B | $1.5B |

| 5 Maisons × 10 Countries | 50 | $11.9B | $7.5B |

| 10 Maisons × 20 Countries | 200 | $47.6B | $30.0B |

Insights

Tiered PENo

Strategy

- LAMY and Montblanc can each offer collections across all 3 levels, ensuring accessibility and prestige coexist.

Volume vs. Prestige

- Everyday PENos = growth driver (biggest unit sales, 30%+ CAGR).

- Premium PENos = steady uplift (~20% CAGR).

- Luxury PENos = halo effect, brand prestige, ~10% CAGR but very high ASP.

Portfolio Effect

- By 2031, a single Maison–Penmaker partnership could add ~$61M vessel sales in one country.

- Multiply across 10+ countries or 5+ Maisons, and Penmakers unlock hundreds of millions in new PENo sales globally.

“PENomizer enables penmakers to monetize across three tiers — Everyday (volume), Premium (professional), and Luxury/Bespoke (collectible). By 2031, a LAMY or Montblanc portfolio could generate ~$61M PENo sales in a single country, scaling into the hundreds of millions globally, all while leveraging their design DNA and heritage.”